Roof replacement is a big job for any homeowner. It means putting a new roof on your house. This can cost a lot of money. Many people wonder if their home insurance can help pay for a new roof. This article will explain how to make that happen.

Is your roof looking old or damaged? You might need to replace it soon. The cost of a new roof can be very high. Most homeowners don’t have enough savings to pay for it all at once. This can be very stressful.

But don’t worry too much! Your home insurance might be able to help. Many insurance plans cover roof damage. This article will show you how to get your insurance company to pay for your new roof. Keep reading to learn all about it.

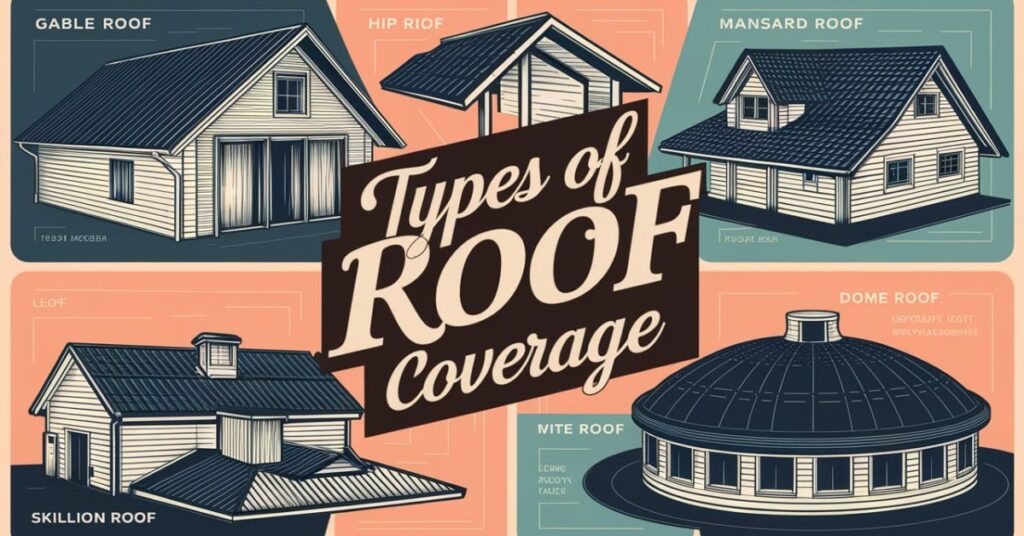

Understanding Your Roof Insurance

Home insurance can be very confusing. It often uses big words and has many strange rules. But it’s really important to know what your insurance covers. This knowledge can save you a lot of money when you need a new roof.

Most home insurance plans do cover roof damage. But they don’t cover all types of damage. They usually pay for damage from sudden events. These can be things like big storms, fires, or trees falling on your roof.

Insurance doesn’t usually pay for old roofs that are just worn out. If your roof is old and needs to be replaced, you’ll probably have to pay for it yourself. That’s why it’s good to take care of your roof. Regular check-ups can help your roof last longer.

Types of Roof Coverage

There are two main types of roof replacement coverage in most insurance policies. These are repair coverage and replacement coverage. It’s important to know which one you have. This will help you know what to expect from your insurance company.

Repair coverage only pays for fixing your roof. It doesn’t pay for a whole new roof replacement. This type of coverage is less common. It also pays less as your roof gets older. The older your roof is, the less money you’ll get from your insurance.

Replacement coverage is more common. It pays to fix your roof replacement it if needed. This type of coverage doesn’t care how old your roof is. It will pay to make your roof like new again. This is the better type of coverage to have.

Steps to Get Insurance to Pay for Your Roof

The main steps to get your insurance to pay for your new roof:

- Check your insurance policy to see what it covers

- Look for damage on your roof and take pictures

- Call your insurance company to report the damage

- Have an inspector from the insurance company look at your roof

- Get quotes from several roofing companies

What to Do When Your Roof is Damaged

After a storm, check your roof for damage. Look for missing shingles or holes. Check inside for water stains on the ceiling. These could mean your roof is leaking.

If you see damage, take pictures right away. Try to stop more damage from happening. You might need to cover holes with a tarp. Call your insurance company to report the damage.

1. Check Your Roof

After a big storm, it’s a good idea to look at your roof replacement. Can you see any damage from the ground? Look for missing shingles or holes. Also check inside your house. Do you see any water stains on the ceiling? These could mean your roof is leaking.

2. Take Pictures

If you see any damage, take pictures right away. Use your phone or a camera. Try to get clear, close-up shots of the damage. These pictures will be very helpful when you talk to your insurance company later.

3. Make Temporary Fixes

If your roof is leaking, try to stop more damage from happening. You might need to put a tarp over the damaged area. This can keep rain out until you can get it fixed properly. Keep your receipts if you buy anything to make these fixes.

4. Call Your Insurance Company

Let your insurance company know about the damage right away. They will tell you what to do next. They might send someone to look at your roof. This person is called an adjuster. They will decide if your insurance will pay for the damage.

5. Get a Professional Roof Inspection

It’s a good idea to have a roofing company look at your roof replacement too. They can tell you how bad the damage is. They can also give you a quote for fixing or replacing your roof. This can help if you need to argue with your insurance company.

Choosing a Good Roofing Company

Picking a good roofing company is very important. A bad roofer can cause more problems. They might do a poor job or charge too much. How to find a good roofer.

Ask friends and family for suggestions. They might know a good roofer. You can also look online for reviews. Look for roofers with lots of good reviews.

Make sure the roofer has a license and insurance. Ask to see proof of these. A good roofer will be happy to show you. This protects you if something goes wrong during the work.

Get quotes from at least three different roofers. This helps you find a fair price. Be wary of prices that seem too low. Sometimes, very low prices mean poor quality work.

Read this article: How Much Is Bond Insurance For A Conservator In California

Common Roof Damage Covered by Insurance

Let’s uncover the most common types of roof damage that insurance typically covers knowing this could save you thousands of dollars and a lot of headaches down the road.

| Type of Damage | Usually Covered? | Notes |

| Storm damage | Yes | Includes wind and rain damage |

| Fire damage | Yes | Even if the fire started inside the house |

| Fallen trees | Yes | If the tree fall was sudden and unexpected |

| Hail damage | Yes | Even small hail can cause damage |

| Wind damage | Yes | Including damage from flying debris |

| Normal wear | No | Regular aging is not covered |

Filing Your Insurance Claim

Once you know your roof is damaged, it’s time to file a claim. This means asking your insurance to pay for the damage. Filing a claim can seem scary, but it doesn’t have to be. What you need to do.

First, call your insurance company. Tell them about the damage to your roof. They will ask you some questions about what happened. Answer them as best you can. They will then tell you what to do next.

Your insurance company will send an adjuster to look at your roof replacement. The adjuster decides if your claim will be approved. They will look at the damage and decide how much money you should get for repairs or replacement.

What Happens After You File a Claim

After you file a claim, you’ll need to wait for a while. Your insurance company needs time to review your claim. This can take a few days or even a few weeks. Try to be patient during this time.

If your claim is approved, your insurance will tell you how much they’ll pay. This might not be enough to cover all the costs of your roof replacement. You might need to pay some money yourself. This is called a deductible.

If your claim is denied, don’t give up right away. You can appeal the decision. This means asking the insurance company to look at your claim again. You might need to provide more information about the damage to your roof.

Tips for a Successful Claim

When filing a claim for roof replacement, be honest and thorough. Take many clear photos of the damage to your roof. Keep all receipts for any temporary repairs you make. Write down dates and details of the damage and your actions.

Act quickly when you notice roof damage. Don’t wait to call your insurance company. Know what your policy covers before you file a claim. Work with your insurance adjuster in a friendly, helpful way.

1. Keep Good Records

Write down everything about your roof damage. Note when it happened and what caused it. Keep all papers and photos in one place. This makes it easier when talking to your insurance company about your roof replacement.

2. Be Honest

Always tell the truth about your roof damage. Don’t try to make it seem worse than it is. Insurance companies can tell when people are not being honest. This could cause them to deny your claim for roof replacement.

3. Know Your Policy

Read your insurance policy carefully. Know what it covers and what it doesn’t. This helps you understand what to expect from your claim. It also helps you talk to your insurance company about your roof replacement.

4. Act Quickly

Don’t wait to report roof damage. Most policies have a time limit for reporting damage. If you wait too long, your claim might be denied. Report the damage as soon as you notice it.

5. Work with Your Adjuster

Be nice to the insurance adjuster. They are just doing their job. Answer their questions honestly. Show them all the damage. The more you help them, the better chance you have of getting your claim approved.

Common Reasons Claims are Denied

Sometimes, insurance companies say no to paying for a new roof. Common reasons why:

- The roof is too old and was already in bad shape

- The damage is from normal wear and tear, not a sudden event

- You didn’t take good care of your roof over the years

- You waited too long to report the damage to your roof

- The type of damage isn’t covered by your insurance policy

What to Do if Your Claim is Denied

If your insurance won’t pay for your roof replacement, you have options. Don’t give up right away. There are things you can try to get help with your roof costs.

You can appeal the decision. This means asking the insurance company to look at your claim again. You might need to provide more information about the damage. Sometimes, this can change their mind about paying for your roof replacement.

If appealing doesn’t work, you can file a complaint. Each state has an insurance department. They can help with insurance problems. They might be able to help you with your claim for roof replacement.

You can also hire a public adjuster. This is someone who works for you, not the insurance company. They can help fight for your claim. But remember, they will charge a fee for their help.

Preventing Future Roof Damage

Once you get your new roof, you’ll want to keep it in good shape. Some tips to prevent future damage:

- Have your roof inspected every year by a professional

- Clean your gutters regularly to prevent water buildup

- Trim trees near your house to prevent branches from falling on your roof

- Fix small problems quickly before they become big ones

- Make sure your attic has good ventilation to prevent ice dams in winter

Taking good care of your roof can help it last longer. This means you won’t need to replace it as often. It can also help you avoid problems with insurance claims in the future.

Final Words

Getting a new roof can be stressful and expensive. But your home insurance might be able to help pay for roof replacement. It’s important to understand your policy and know what to do if your roof is damaged.

Remember to act quickly if you notice roof damage. Take pictures and call your insurance company right away. Choose a good roofing company to inspect and fix your roof. They can help you through the process of replacement.

Don’t be afraid to ask questions or appeal if your claim is denied. With patience and persistence, you can navigate the process of getting insurance to pay for your new roof. And once you have your new roof, take good care of it to avoid future problems.

Frequently Asked Questions

How often should I have my roof inspected?

It’s good to have your roof checked once a year. Also check after big storms.

Will my insurance rates go up if I file a roof claim?

They might, but not always. It depends on your insurance company and claim history.

How long does a roof replacement take?

Most roof replacements take 1-3 days. Bigger or more complex roofs might take longer.

Can I stay in my house during a roof replacement?

Yes, but it will be noisy. You might want to leave during work hours.

How long should a new roof last?

A good new roof should last 20-30 years. Some types of roofs can last even longer.

David: Seasoned financial expert with 5 years in banking and investments.

Skilled in personal finance, market analysis, and wealth management. Empowers clients to achieve financial goals.