Life insurance is a way to protect your loved ones financially if you die. It’s not just for homeowners. Renters can also get it to help their families pay rent and bills.

Many people think life insurance is only for those who own houses. But this isn’t true. Renters can benefit from life insurance too. It can give peace of mind to those who live in apartments.

Life insurance for renters works like it does for homeowners. It pays money to your family if you die. This money can help them keep living in the apartment and pay for other needs.

Why Do Renters Need Life Insurance?

Renters often think they don’t need life insurance. They may feel they don’t have enough money or assets. But this isn’t always the case. It can be very helpful for renters.

Many renters have families who depend on them. If a renter dies, their family might struggle to pay rent. They might have to move or face money problems. It can help prevent this by giving the family money.

Renters also have other bills besides rent. They pay for food, clothes, and utilities. If a renter dies, these costs don’t go away. It can help cover these ongoing expenses for the family left behind.

Types of Life Insurance for Renters

There are different types of life insurance renters can choose from. The main types are term life insurance and whole life insurance. Each type has its own benefits and drawbacks.

Term life insurance lasts for a set time, like 10 or 20 years. It’s often cheaper than other types. This can be good for renters on a budget. If the renter dies during this time, their family gets money. If not, the insurance ends when the term is over.

Whole life insurance lasts for the renter’s entire life. It costs more than term life insurance. But it also builds cash value over time. This means the renter can borrow money from the policy if needed. It can be a good choice for renters who want lifelong coverage.

How Much Life Insurance Do Renters Need?

How much life insurance you need depends on your situation. There’s no one-size-fits-all answer. But there are some things to think about when deciding.

- Your income: Think about how much money your family would need to replace your income.

- Your debts: Add up all your debts, including credit cards and loans.

- Future expenses: Consider things like your kids’ education or your partner’s retirement.

- Your rent: Calculate how much your family would need to keep paying rent for several years.

- Your savings: If you have savings, you might need less life insurance.

Factors Affecting Life Insurance Costs for Renters

Many things can change how much a renter pays for it. The renter’s age is one of the biggest factors. Younger renters often pay less than older ones.

Health is another key factor in its costs. Renters who are in good health usually pay lower premiums. Those with health issues may face higher costs.

1. Age

Age is a big factor in its costs. Younger renters usually pay less. This is because they are less likely to die soon. Older renters may pay more for the same coverage.

2. Health

Health also affects it costs. Renters in good health often pay less. Those with health problems may pay more. Some insurers may ask for a medical exam before giving coverage.

3. Lifestyle

A renter’s lifestyle can change their insurance costs. Smokers often pay more than non-smokers. People with dangerous jobs or hobbies may also pay more. This is because they have a higher risk of dying.

4. Coverage Amount

The amount of coverage a renter chooses affects the cost. More coverage means higher premiums. Renters should choose an amount that fits their needs and budget.

5. Policy Type

The type of policy a renter chooses also affects the cost. Term life insurance is usually cheaper than whole life insurance. But whole life insurance lasts longer and builds cash value.

How to Choose the Right Life Insurance Policy as a Renter?

Choosing the right insurance policy can seem hard. But it doesn’t have to be. Start by thinking about your needs. How much coverage do you need? How long do you need it for? What can you afford to pay?

Next, look at different types of policies. Term life might be good if you want coverage for a specific time. Whole life might be better if you want lifelong coverage and cash value. Compare the costs and benefits of each.

Don’t forget to shop around. Different companies offer different rates. Get quotes from several insurers. Look for a company with good financial strength and customer service. Remember, the cheapest policy isn’t always the best.

The Process of Getting Life Insurance as a Renter

Getting it as a renter is similar to getting it as a homeowner. A basic overview of the process:

- Decide how much coverage you need

- Choose between term and whole life insurance

- Get quotes from different insurance companies

- Fill out an application with your chosen company

- Take a medical exam (if required)

- Wait for the company to review your application

- If approved, review and sign your policy

- Start paying your premiums

Benefits of Life Insurance for Renters

It can help renters in many ways. It gives peace of mind to those worried about their family’s future. Knowing their loved ones will be taken care of can reduce stress.

For families, it can prevent financial hardship. If a renter dies, their family might struggle to pay rent and bills. Its money can help them keep their home and maintain their lifestyle.

It can also help with future plans. The money could be used for children’s education or other goals. It can ensure that a renter’s dreams for their family are still possible, even if they’re not there.

Read this article: When Will a Speeding Ticket Show Up on Insurance?

Comparing Life Insurance Options for Renters

A simple comparison of term and whole life insurance for renters:

| Feature | Term Life Insurance | Whole Life Insurance |

| Duration | Set period (e.g., 10-30 years) | Lifelong |

| Cost | Generally lower | Generally higher |

| Cash Value | No | Yes |

| Flexibility | Can be converted to whole life | Fixed |

| Best For | Temporary needs | Lifelong coverage |

How to Get Life Insurance as a Renter?

Getting it as a renter is not hard. The first step is to decide how much coverage you need. Think about your rent, bills, and family’s needs. This will help you choose the right amount.

Next, compare different insurance companies. Look at their prices and what they offer. Some companies may have better deals for renters. Others might have extra benefits that you like.

Once you’ve chosen a company, you’ll need to apply. This usually involves answering questions about your health and lifestyle. Some policies might require a medical exam. After this, the company will decide whether to offer you insurance and at what price.

Common Myths About Life Insurance for Renters

Many people have wrong ideas about life insurance for renters. One common myth is that it’s too expensive. In reality, many renters can find affordable options. Term life insurance, in particular, can be quite cheap.

Another myth is that single renters don’t need it. But even single people might have debts or want to leave money to their family. It can help with this.

Some think life insurance through work is enough. While this is helpful, it might not provide enough coverage. It also usually ends if you leave your job. Having your own policy gives you more control and security.

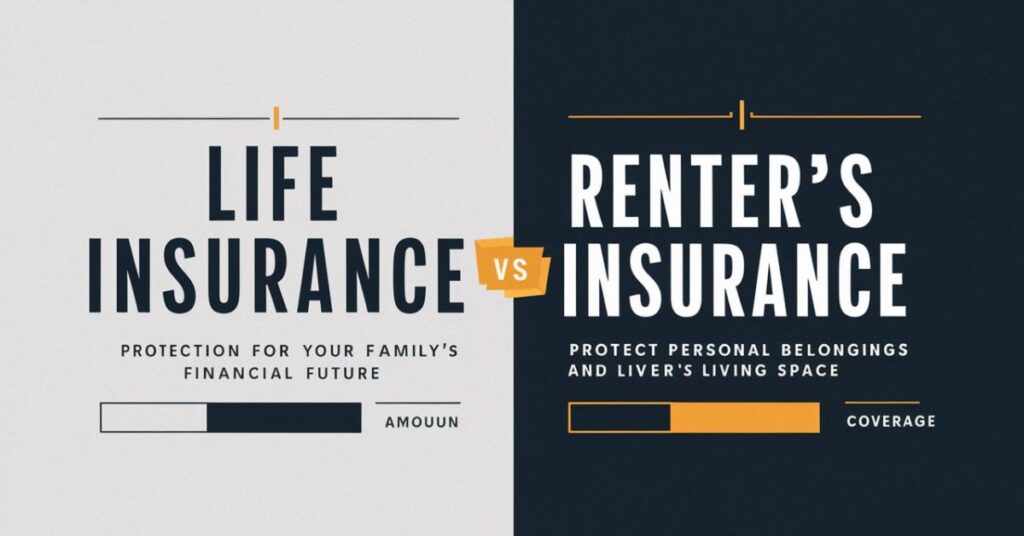

Life Insurance vs. Renter’s Insurance

Life insurance and renter’s insurance serve different purposes for people who rent their homes. It provides financial protection for your loved ones if you pass away. It can help them cover rent, bills, and other expenses after you’re gone.

Renter’s insurance, on the other hand, protects your personal belongings while you’re alive. It covers your possessions if they’re damaged, destroyed, or stolen. Renter’s insurance also provides liability coverage if someone gets injured in your apartment.

1. What is Renter’s Insurance?

Renter’s insurance protects a renter’s belongings. It covers things like furniture and clothes. It can also help if someone gets hurt in your apartment. But it doesn’t give money to your family if you die.

2. How Do They Differ?

Life insurance and renter’s insurance serve different purposes. It pays your family if you die. Renter’s insurance protects your stuff and covers some types of accidents. They work in different ways to protect renters.

3. Why You Might Need Both?

Having both types of insurance can give renters full protection. Renter’s insurance protects your things now. It protects your family’s future. Together, they provide comprehensive coverage for renters.

The Future of Life Insurance for Renters

The life insurance industry is changing. More companies are offering policies designed for renters. These policies often have features that fit renters’ needs better. They might be more flexible or have lower costs.

Technology is making it easier to get it. Many companies now offer online applications. This can make the process faster and more convenient for busy renters.

As more people rent for longer, it for renters will likely become more common. Companies may create new types of policies to meet renters’ unique needs. This could make it even more accessible and useful for renters in the future.

Final Words

It is not just for homeowners. Renters can and should consider getting it too. It can provide important financial protection for their loved ones.

There are many options available for renters who want it. From term life to whole life policies, renters can find coverage that fits their needs and budget. The key is to understand your options and choose wisely.

Remember, the goal of it is to provide peace of mind. For renters, knowing their family will be taken care of financially can be a great comfort. It’s worth taking the time to explore its options, even if you don’t own a home.

Frequently Asked Questions

Can I get life insurance if I’m a student renting an apartment?

Yes, students can get it. Many companies offer policies for young adults.

Does my credit score affect my life insurance rates as a renter?

Credit scores usually don’t affect its rates. Your health and age matter more.

Can I change my life insurance policy if I move from renting to owning?

Yes, you can often adjust your policy or get a new one when your situation changes.

Is life insurance tax-deductible for renters?

Generally, its premiums are not tax-deductible for individuals, including renters.

Can I name my landlord as a beneficiary on my life insurance policy?

You can, but it’s unusual. Most people name family members or close friends.

David: Seasoned financial expert with 5 years in banking and investments.

Skilled in personal finance, market analysis, and wealth management. Empowers clients to achieve financial goals.